In May 2020, Angela M. Ladetto, Vice President of Business Intelligence and Research, Detroit Regional Partnership, asked Paul Traub, an economist with the Federal Reserve Bank of Chicago’s Detroit Branch, a series of questions about how COVID-19 has affected the Detroit region, Michigan, and the U.S. and what may be in store in the coming months.

Ladetto: In all your years as an economist have you ever experienced anything quite like this? Is there any other time in history that you can compare it to?

Traub: The first thing that comes to mind is the HIV/AIDS epidemic, which was first reported in the United States in 1981. This disease has existed for almost 40 years, and there are currently close to 40 million people infected with HIV across the globe. It is estimated that since the disease was discovered, there have been over 32 million deaths worldwide, and there is still no vaccine.[1] Like the COVID-19 virus, HIV can be unknowingly spread by a person who has it but is asymptomatic; it is estimated that one in seven people with HIV do not know they have it.[2] In addition, HIV/AIDS affects minorities and economically challenged individuals in a disproportionate way, as does COVID-19.[3] As with the novel coronavirus, testing, tracing, and isolation is still the most effective way of preventing the spread of HIV/AIDS. According to data from the Centers for Disease Control and Prevention (CDC), there were 16,350 deaths due to HIV/AIDS-related illnesses in the U.S. and six dependent areas in 2017.[4] Over the years, HIV has affected not only the health of individuals, but also the lives of their families and the economic well-being of their local communities and even entire countries. Many of the nations that have been hit the hardest by HIV/AIDS also suffer from other diseases, food insecurity, and additional serious issues.[5] However, over my 30 years as an economist I have never seen anything as devastatingly disruptive as the COVID-19 pandemic. It has brought the global economy to a virtual halt, and economic outlooks are all dependent on how quickly a cure or vaccine can be found.

Ladetto: According to the Detroit Economic Activity Index (DEAI) you released in early March for data through the end of 2019, the economy was growing at a pace faster than trend, but then the coronavirus hit around the middle of Q1 this year. Which industries are being critically impacted? Are there any industries in jeopardy of suffering a negative transformation like manufacturing did in the 2008–09 recession?

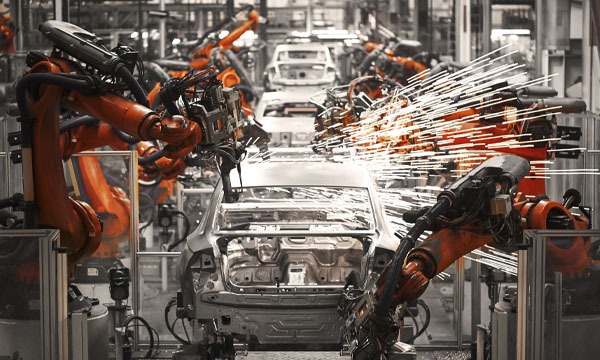

Traub: The DEAI is broken down into four categories: income, labor, real estate, and trade. While all of these categories contribute to the city’s economic growth, the labor category continues to be the DEAI’s largest contributor.[6] Based on this understanding, using job creation or destruction as a proxy for changes in economic output is one way of estimating the economic impact of the virus on the southeast Michigan region. Before the virus hit, much of the positive growth in the DEAI was being driven by job creation resulting from the revival of the automotive industry and the surge of new businesses along the Woodward Corridor in Detroit. Data from the U.S. Bureau of Labor Statistics (BLS) indicates that roughly 62% of Michigan’s motor vehicle and parts jobs are based in plants in the Detroit–Warren–Dearborn metropolitan statistical area (MSA). This implies that six out of every ten automotive jobs in Michigan are located in its southeast region. According to the Economic Policy Institute, each durable goods manufacturing job leads to the creation of around 7.5 other jobs. These jobs include parts supplier jobs; financial services jobs (e.g., to facilitate auto loans); and jobs supported with spending by automotive industry employees (and by their tax revenues). Jobs in the last category include those at restaurants and retail establishments (and public sector jobs).[7] With almost all automotive manufacturing and parts plants closed in Michigan, the impact on the Detroit region’s employment has been severe. This is a tremendous loss of income and spending power. Once the plants start to reopen on May 18, it could take a number of months before they bring back anywhere near the number of workers who were furloughed or laid off. These job losses will have a significant impact on the region’s economy and could result in the closures of many newer Detroit businesses. The businesses that need an uninterrupted flow of revenue to stay in operation are the most vulnerable. Unlike some businesses in places such as New York City that have been family owned for generations, many of Detroit’s new restaurants and small businesses are still young and may not have the accumulated wealth necessary to weather a long period of little to no revenue.

Besides the auto industry, I think another sector of the economy that will be severely impacted by COVID-19–not only in Michigan but across the country–is higher education. Universities and colleges were already facing major challenges from rising costs, funding cuts, and declining enrollments.[8] To offset these realities, some schools had begun relying more heavily on their sports programs as a way of generating revenue; other institutions turned to recruiting out-of-state or international students to help them hit their enrollment targets. Both ways of raising revenue are more difficult to pursue now. In regard to the former option, it is unknown if there will be any college sports in the foreseeable future. As for the latter option, it will likely not produce the same results because more domestic students may want to stay in state to be closer to home and international students may not be able to come to the U.S. because of COVID-19-related travel restrictions. In-person classes were moved to online platforms in mid-March, and it is not yet known what classes will look like in the fall. Some schools could require limiting classroom sizes to enforce the necessary social distancing. The COVID-19 pandemic may well have permanently changed how some classes are taught. The University of Michigan announced it will lose anywhere from $400 million to $1 billion because of the actions taken to limit the spread of the virus, and all revenue sources are now in question. President Mark Schlissel recently announced a number of new cost-cutting measures, which will negatively impact spending, hiring, salaries, hours of operation, and construction projects.[9] Many institutions of higher education face even greater challenges, as they lack large endowments or other financial cushions. The longer we go without a vaccine, the more likely there will be consolidations and closures of postsecondary institutions.[10]

Ladetto: What will happen to businesses if the shutdown lasts to the end of May or even longer? What are some of the factors that firms need to consider before the shutdown order is lifted?

Traub: The longer the need to maintain social distancing measures, the more difficult it will be to reopen businesses. Even before the lockdown is eased or lifted, there will be hard decisions for firms to make. For instance, some companies may opt to keep the same number of workers on site and therefore require more office space than before to maintain proper social distancing. If several firms go this route, commercial rents might rise. The other option is to have fewer workers on the floor and have others work from home. Companies may decide they don’t need the same amount of floor space to accommodate their in-house workforce, creating excess capacity and negatively affecting commercial rents. In addition, some workers may be unwilling to go back to their offices for fear of contracting the disease. To make sure they have a workforce when the pandemic ends, many businesses that are currently idled are making concerted efforts to stay in touch with their laid-off workers. The hope is to be able to retain a viable workforce so that when restrictions are lifted, businesses are able to resume operations fairly quickly. Yet, as more and more restaurants and retail shops keep their doors closed (some for good), food suppliers and retail goods manufacturers will be facing a period of transition as they search for new customers.

Ladetto: The 11-county Detroit region is seeing an unprecedented number of initial unemployment claims right now. Can you share how this compares with the claims made during the 2008–09 recession? And how does Michigan compare with the nation now?

Traub: The unemployment rate in the U.S. reached a peak of 10% in October 2009.[11] During the Great Recession and its immediate aftermath, 8.7 million jobs were lost. Total payroll employment bottomed out in February 2010, at 129.7 million jobs. Between February 2010 and February 2020, the U.S. added 22.8 million jobs. The COVID-19 pandemic has wiped away all of those employment gains from the past decade in just a few weeks. From the week ending March 21 through the week ending May 9, 36.5 million U.S. workers filed for unemployment. During April alone, 20.1 million U.S. workers sought unemployment benefits. This would imply a significant increase in the unemployment rate that month. At 14.7%, the official unemployment rate for April was very high by historical standards. However, even a rate this high may not capture all of the workers who are out of a job now. One factor may be that 6.4 million workers left the labor force in April (a decrease of 3.9%), so they are no longer included in the ranks of the unemployed and, therefore, not included in the calculation of the official unemployment rate (which is the number of the unemployed divided by the labor force). To be considered officially unemployed by the U.S. Bureau of Labor Statistics, you must be out of work and either on temporary layoff or actively searching and available for a new job.

So, while the unemployment rate is an important indicator of labor market health, it doesn’t always capture the entire impact of an event as severe as a pandemic. A 3.9% drop in the labor force in just one month is also quite significant. Michigan’s employment doesn’t mirror that of the U.S. because the state’s payroll employment actually peaked long before the Great Recession (reaching close to 4.7 million jobs in June 2000) and continued to drift downward through the 2008–09 recession until bottoming out at about 3.8 million jobs in the in July 2009. During this period, Michigan lost a total of 864,000 jobs. Following the Great Recession, Michigan’s payroll employment peaked again in February 2020 at 4.5 million–200,000 jobs below the previous peak in 2000. Almost all of these shifts in Michigan’s payroll employment over the past two decades were related to changes in the manufacturing sector, including the restructuring of the state’s automotive industry. Since the start of the pandemic, Michigan has seen an estimated 1.3 million workers file for unemployment from the week ending March 21 through the week ending May 2 (the latest available data). This equals almost 26% of Michigan’s total labor force in March. In April alone, 747,468 Michigan workers filed for unemployment–equivalent to 15.2% of Michigan’s labor force in March. Allowing for a percentage reduction in Michigan’s labor force in line with the one experienced by the entire U.S. labor force would imply an unemployment rate of 16.0% for the state in April. This rate would be nearly four times Michigan’s official unemployment rate of 4.1% in March. Given that approximately one-fifth of Michigan’s confirmed COVID-19 cases were in the city of Detroit as of mid-May, it isn’t unreasonable to assume that Detroit’s April unemployment rate could be even higher than the state’s once it is reported.[12]

Ladetto: While we hope most will be unemployed only temporarily, do you have a sense of how many of those folks will return to work once the state begins to reopen? Does the Federal Reserve have an indication of how the Paycheck Protection Program will impact workers’ willingness to return to their jobs once the economy is reopened? Does the additional $600 per week in unemployment benefits hurt employers looking to hire workers deemed “essential,” and will it impact most employers when the economy begins to open up again? Was it too generous?

Traub: As part of the CARES Act,[13] workers who were laid off because of the COVID-19 pandemic are able to collect $600 per week of unemployment pay in addition to their state’s regular unemployment coverage. An unemployed Michigan worker could qualify for up to $362 per week in unemployment pay (including allowances for dependents). So, in Michigan, the weekly unemployment benefit could be up to $962.[14] This is only slightly lower than the $978 per week earned on average by private sector employees in March.[15] So an argument could be made that someone is better off staying home and collecting unemployment than going back to work. However, the average weekly wage is different depending on the worker’s hourly rate and the number of hours worked. The average number of hours worked by private sector employees used in the $978 average weekly wage estimate is 34.1 hours. This is because the estimate includes part-time workers. In reality, most full-time employees work at least 40 hours a week, which would result in an average weekly wage of $1,147, or 19% more than the enhanced unemployment pay. If there is overtime involved, the difference would be even greater. Moreover, many jobs include benefits, such as health insurance or paid time off. When all these nonwage benefits are taken into account, the difference would be much greater still. So, there are financial incentives for people to return to work, despite the historically high unemployment benefits that are currently available.

Ladetto: OK, crystal ball time: What can we expect when the economy begins to lift restrictions? What would be your recommendation on how the state or nation should open back up?

Traub: How long it takes for the economy to open back up is unknown–it is very difficult to predict the future of the novel coronavirus and its impact on the U.S. economy. As Dr. Fauci keeps saying, the virus is calling all the shots right now. How the economy will look in six to 12 months and beyond varies. It depends in part on which measure you’re studying. According to the May 2020 Blue Chip Economic Indicators consensus forecast, there will be a 32.1% percent decline in economic activity in 2020:Q2, following 4.8% decrease in 2020:Q1–on a seasonally adjusted annual rate basis. This consensus forecast also predicts that after the two-quarter drop, there will be a rebound, with economic growth at 11.6% in 2020:Q3. Their outlook for quarterly growth rates for the U.S. has the visual appearance of an emerging V-shape.[16] However, per the same Blue Chip consensus forecast, total U.S. GDP is projected to fall close to $2.0 trillion from its level in 2019:Q4 and to not get back there until sometime in 2022; so, in dollar terms, U.S. GDP’s path implies more of a U-shaped recovery or something that looks like the Nike swish. The concern of many is that if we reopen the economy too soon, another wave of infections could lead to another decline in economic output; this would lead to a W-shaped economic recovery, where we face a sharp economic contraction and recovery (at least) twice in a relatively short period of time. If we open up the economy before there is a vaccine, there will be increased needs for testing and personal protective equipment (PPE) for all employees, plus other workforce precautions that will limit productivity and output.

The longer the country has to stay on lockdown, the longer it will take for businesses and consumers to get back to where they were before the pandemic. Even if businesses could miraculously restart their operations right where they left off, there’s no certainty that people will be comfortable enough to immediately return to the same level of pre-COVID-19 consumption (and many will not be able to until they regain employment). The University of Michigan conducted a survey that shows that 61% of all households are more concerned about their health than they are about being in isolation (13%) or their personal finances (23%).[17] Because many people will not be called back to their jobs (or find new ones) immediately after the lockdowns are eased or lifted, those who are out of work for longer will need time to get their finances in order once they’re employed again. For me, this pandemic has magnified how fragile certain parts of our current economic system truly are. It has also shown me that there is definitely a role for government in taking care of our society and its workforce. The COVID-19 crisis has shown me the importance of listening to the experts because especially at times like this, it’s all about the data and those who can explain them clearly to everyone.

[1] Available online, https://www.unaids.org/en/resources/fact-sheet.

[2] Available online, https://www.hiv.gov/hiv-basics/overview/data-and-trends/statistics.

[3] Available online, https://www.hiv.gov/hiv-basics/overview/data-and-trends/impact-on-racial-and-ethnic-minorities.

[4] Available online, https://www.cdc.gov/hiv/statistics/overview/index.html.

[5] Available online, https://www.hiv.gov/federal-response/pepfar-global-aids/global-hiv-aids-overview.

[6] Available online, https://www.chicagofed.org/publications/chicago-fed-letter/2020/434.

[7] The Economic Policy Institute’s latest employment multipliers are available online, https://www.epi.org/publication/updated-employment-multipliers-for-the-u-s-economy/.

[8] Available online, https://tcf.org/content/report/michigans-college-affordability-crisis/?agreed=1.

[9] Available online, https://president.umich.edu/news-communications/letters-to-the-community/a-covid-19-update-from-president-mark-s-schlissel/.

[10] Available online, https://www.forbes.com/sites/lucielapovsky/2020/04/03/the-corona-virus-will-be-the-death-knell-for-some-colleges/#52e090ad44af.

[11] All the labor numbers cited in my response here are based on U.S. Department of Labor/BLS data accessed from Haver Analytics.

[12] Available online, https://www.michigan.gov/coronavirus/0,9753,7-406-98163_98173—,00.html.

[13] The full name of the CARES Act is the Coronavirus Aid, Relief, and Economic Security Act; it is available online, https://www.congress.gov/bill/116th-congress/senate-bill/3548/.

[14] Available online, https://www.michigan.gov/leo/0,5863,7-336-78421_97241_98585_98650-522548–,00.html.

[15] Unless indicated otherwise, the labor numbers discussed in my response here are based on BLS data accessed from the St. Louis Fed’s FRED database.

[16] See the May 10, 2020, issue of the Blue Chip Economic Indicators. Information on the Blue

Chip Economic Indicators consensus forecast is available online, https://lrus.wolterskluwer.com/product-family/

blue-chip.

[17]Available online, https://news.umich.edu/restoring-consumer-confidence/.